how to pay late excise tax online

Residents who own motor vehicles have to pay taxes based on the value of their vehicles each year. This penalty is in addition to all other penalties.

Federal Excisetax Form2290 Quarterly Federal Excise Tax Form720 International Fueltax Agreement Report Ifta All These Tax Deadline Filing Taxes Tax

Form 720 includes several pages of excise taxes that your business might have to pay and the rate.

. The penalty rate is 5 percent per month or part of month up to maximum of 25 percent computed on the amount of tax required to be shown on the return. The request must be made before the due date. Get your bill in the mail before calling.

You are personally liable for the excise until the it is paid off. This information will lead you to The State Attorney Generals Website concerning the Tax. You must create a serial number in this format.

If your vehicle isnt registered youll have to pay personal property taxes on it. This is in addition to the 5 percent failure-to-pay penalty. The demand fee is 5.

Filing electronically is the fastest and most accurate way to file operational reports and excise tax returns with TTB and also provides a secure way to make excise tax payments. 100 percent late payment and late filing penalty if you dont file returns for three consecutive years by the original or extended return filing due date of the third year. TTB Excise Tax Returns and payments must be mailed to.

Late returns or payment are subject to penalties and interest. What happens if you pay your excise tax late. For filing help call 1-800-829-1040 or 1-800-829-4059 for TTYTDD.

Motor Vehicle Excise. You can also contact your employer or payer of income. Please use this page to search for delinquent MOTOR VEHICLE EXCISE TAX bills.

The taxes will be reported on Form 720 Quarterly Federal Excise Tax Return and Form 6627 Environmental Taxes. Where do you pay late Motor Vehicle Excise taxes. How to Report Pay and File Federal Excise Taxes.

Form 433-A Collection Information Statement for Wage Earners and Self-Employed Individuals PDF. The payment is credited to your account and applied to your liability when your excise tax return is received. The collector will send a demand.

File the first taxpayers report with Form 720 for the quarter for which the report relates. Payment at this point must be made through our Deputy Collector Kelley Ryan Associates 508 473-9660. If you need wage and income information to help prepare a past due return complete Form 4506-T Request for Transcript of Tax Return and check the box on line 8.

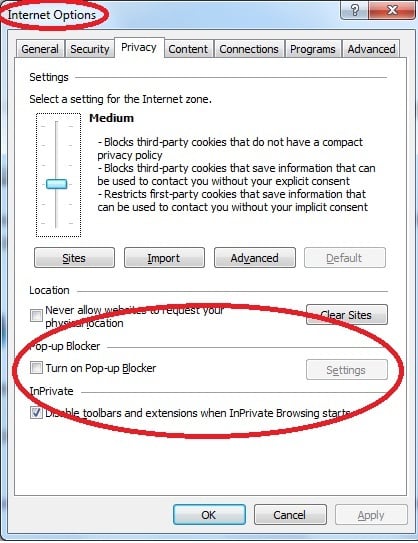

Current Fiscal Year Tax Rate. If an extension is more than 30 days you must pay the department an amount equal to the estimated tax liability for the reporting period s you received the extension. Online payments for excise tax are accepted only within the 30 days from the date of issue on the original tax mailed.

Form 720 the Quarterly Federal Excise Tax Return is used to report on federal excise taxes collected by the business for a variety of products and services. Request for Tax Information. Excise tax return extensions.

Pay your outstanding obligations online by clicking on the Green area on the home page. You must have Signing Authority TTB Form 51001 or Power of Attorney TTB Form 50008 on file with TTB to submit Federal Excise Tax Returns and. Contact Us Your one-stop connection to DOR.

Help Filing Your Past Due Return. The Department can waive late return penalties under certain circumstances. Visit their website here.

Publication 1854 How to Prepare a Collection Information Statement Form 433-A PDF. Then select the Municipality you wish to pay and complete the process by entering the Bill Number Tax year and Tax type which is normally EX. 2000-01 for PERIOD returns and in this format P-2001-001 for PREPAYMENT returns.

Tax Department Call DOR Contact Tax Department at 617 887-6367. Internal Revenue Code 4121. Online Payments Taxes Water Sewer Trash Parking Ticket Appeal Form.

LICENSE OR REGISTRATION. Not just mailed postmarked on or before the due date. Department of the Treasury.

Notice 2021-66 provides an initial list of taxable chemical substances and guidance for registration with the Form 637 Application for Registration For Certain Excise Tax Activities. Municipal Lien Certificate Application. Stay current with filing frequencies and operational reports excise tax and export due dates by subscribing to receive automated reminders when it.

Item 1 - Serial Number. You pay an excise instead of a personal property tax. A motor vehicle excise is due 30 days from the day its issued.

Kelly Ryan Associates 3 Rosenfeld Dr. If payment is not made within 14 days of the demand the collector will issue a warrant to collect the charge for which is 10. The tax collector must have received the payment.

Receive email updates Sign up for DOR news and updates. As a TTB-regulated industry member you may be responsible for paying federal excise taxes. Please DO NOT mail returns andor payments to the National Revenue Center in Cincinnati Ohio.

File and Pay Online. In this example 2000 is the calendar year covered by the excise tax return and 01 and 001 are the number of the PERIOD excise tax return filed for the year. Motor Vehicle Excise Tax.

TTB Excise Tax PO. They also have multiple locations you can pay including Worcester RMV Leominster RMV and other locations listed on their website. Write EXCISEFIRST TAXPAYERS REPORT across the top of a separate copy of the report and by the due date of Form 720 send the copy to.

MassTaxConnect Log in to file and pay taxes. How To Pay Late Excise Tax Online Hingham Excise Tax Fill Online Printable Fillable Blank Pdffiller How to pay your motor vehicle excise tax get your bill in the mail before submitting online pay your bill online. Tax information for income tax purposes must be requested in writing.

Form 433-B Collection Information Statement for Businesses PDF. Most extensions are less than 30 days. Pay Delinquent Excise.

Hopedale MA 01747 508-473-9660. We send you a bill in the mail. Taxes and Filing.

Online payments will have a NON-REFUNDABLE 45 convenience fee added to your total LastCompany Name. If an excise tax is not paid within 30 days from the assessors mailing date. To complete a search you must provide several pieces of information to ensure we match you to the bills in our system.

Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089. Your obligation as a taxpayer will depend on your circumstances and business type. 20 percent substantial understatement of net tax penalty.

Your 2020 annual excise tax returns must be filed on or before January 14 2021. Excise Tax on Coal. Form 433-F Collection Information Statement PDF.

IRC 6651 a 1 imposes a penalty for the failure to file a tax return by its required due date determined with regard to any extension of time for filing. Depending on the circumstances the Department may grant extensions for filing an excise tax return. There is no statute of limitations for motor vehicle excise bills.

9 am4 pm Monday through Friday.

New Gst Registration Procedure Gst Number Blog Tools Registration Confirmation Letter

A Loss Of Excise Tax Revenue Should Not Stall The Uptake Of Electric Vehicles In Australia Ieefa

Corporate Excise Tax Penalties Waived S Corporation Efile Irs

Online Bill Payments City Of Revere Massachusetts

Motor Vehicle Excise Information Methuen Ma

Characteristics Of Different Types Of Tobacco Excise Tax Structures Download Table

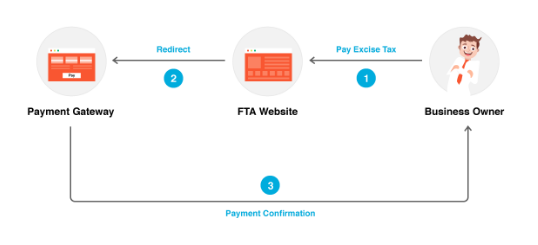

Excise Tax Registration In Uae Excise Tax In Uae

Digital Tax Stamp Businesses Must Comply With New Excise Tax Norm Digital Tax Consulting Business Chartered Accountant

Tax Collector Frequently Asked Questions Town Of North Providence Rhode Island

Excise Tax Return Filing And Payment Zoho Books

Different Types Of Australian Taxes Types Of Taxes Tax Services Business Advisor

Form 720 Excise Taxes Instructions And Guidelines

The Real Deadline For Depositing 401 K Deferrals And What To Do If You Re Late Www Patriotsoftware Com Payroll Software Deposit Employment

Top Benefits By The Best Gst And Income Tax Service Providers In 2022 Filing Taxes Online Taxes File Taxes Online

Characteristics Of Different Types Of Tobacco Excise Tax Structures Download Table

Average Real Federal Excise Taxes In Dollars Per Barrel On Alcoholic Download Scientific Diagram